oklahoma franchise tax payment

Your browser appears to have cookies disabled. Click the Order Cigarette Stamps link on the sidebar and complete the order form.

State And Federal Eitc Benefits Pay Off For Lower Wage Workers Plus Starting This Week Bonus Tips In The Daily Tax Tips Weekly Roundup Tax Tax Credits Worker

Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800.

. Ad Upload Modify or Create Forms. Mine the amount of franchise tax due. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed.

Individual filers completing Form 511 or 511NR should use Form 511-V. Oklahoma City OK 73105. Cookies are required to use this site.

And pay franchise tax. For tax years beginning on January 1 2022 the corporate income tax rate will reduce to 4. 540 540 2ez 540nr schedule x.

Form 512 Form 513 Form 512-E. Oklahoma secretary of state 2300 n. In Oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

The following is the Tax Commissions mission statement as it exemplifies our direction and focus. Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Mail this return to the address below.

Oklahoma corporations must file an Oklahoma income tax return and pay corporate income tax. Other things being equal the corporation will owe Oklahoma corporate income tax in the amount of 30000 6 of 500000. Due is income tax franchise tax or both.

EF-V 2 0 2 FORM 0 Address City State ZIP Daytime Phone Number Federal Employer Identification Number Balance Due Amount of Payment Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890 Do not enclose a copy of. Miscellaneous Taxes Payment Options Forms Publications Forms Ad Valorem Boat Motor. Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

For a corporation that has elected to change its filing period to match its fiscal year. Not-for-profit corporations are not subject to franchise tax. Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. To make this election file Form 200-F. The franchise tax applies solely to corporations with capital of 201000 or more.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Your session has expired. 2021 Form EF-V State of Oklahoma Business Filers Income Tax Payment Voucher Instructions What Is Form EF-V and Do You Have to Use It.

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999. Franchise tax or. Oklahoma Tax Commission Payment Center.

Corporations reporting zero franchise tax liability must still file an annual return. As of 2021 the rate is 6. Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160.

The report and tax will be delinquent if not paid on or before September 15. The Oklahoma State Treasurers Office. In oklahoma the maximum amount of franchise tax a corporation can pay is 20000.

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma. A ten percent 10 penalty and one and one-fourth percent 125 interest. And interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension.

Click the Pay Now button to pay for the stamp order. Our mailing addresses are grouped by topic. Eligible entities are required to annually remit the franchise tax.

Click the continue arrow at the bottom of the screen to navigate to the payment window. Up to 25 cash back Also in 2018 the amount of your corporations capital allocated invested or employed in Oklahoma was 250000. Oklahoma franchise tax is due and payable each year on July 1.

In oklahoma the maximum amount of franchise tax a corporation can pay is 20000. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. You will be automatically redirected to the home page or you may click below to return immediately.

The franchise tax is waived. Please include your return pay-ment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. Use e-Signature Secure Your Files.

Return with your payment if applicable to. Foreign corporations are not obliged to pay the Oklahoma franchise tax but are still liable for the 100 registered agent fee. Mail Form 504-C Application for Extension of Time to File an Oklahoma.

Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return. Banking Operations will complete the agreement with the appropriate banking information entitle the agencys account to receive ACH credit transactions and mail the original completed authorization agreement. If you have already filed the return either electronically or by paper send this voucher with the check or money order for any balance due on the 2021 Form 512 512-S 513 513-NR or 514.

Try it for Free Now. Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. For corporations that owe the maximum amount of franchise tax 20000 their payment is due on May 1st of each year.

With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. Once you have access to your Cigarette Wholesale account on OkTAP you can order stamps. We would like to show you a description here but the site wont allow us.

Franchise tax if filing a consolidated franchise tax return for oklahoma the oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. The corporation will also owe corporation franchise tax in the amount of 31250 125 x 250.

Oklahoma Taxpayer Access Point

Drc Accounting And Consulting Logo Design Consulting Logo Logo Design Logo

Oklahoma Taxpayer Access Point

Oklahoma Taxpayer Access Point

Free Oklahoma Flag Images Ai Eps Gif Jpg Pdf Png And Svg Oklahoma Flag Oklahoma State Flag Oklahoma History

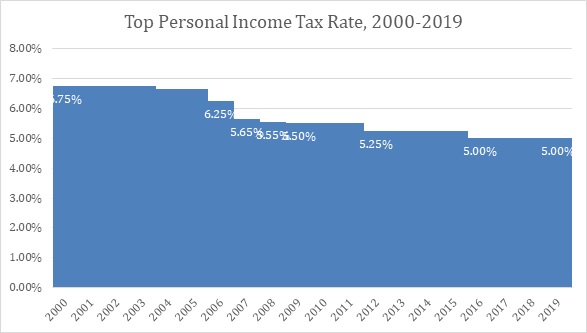

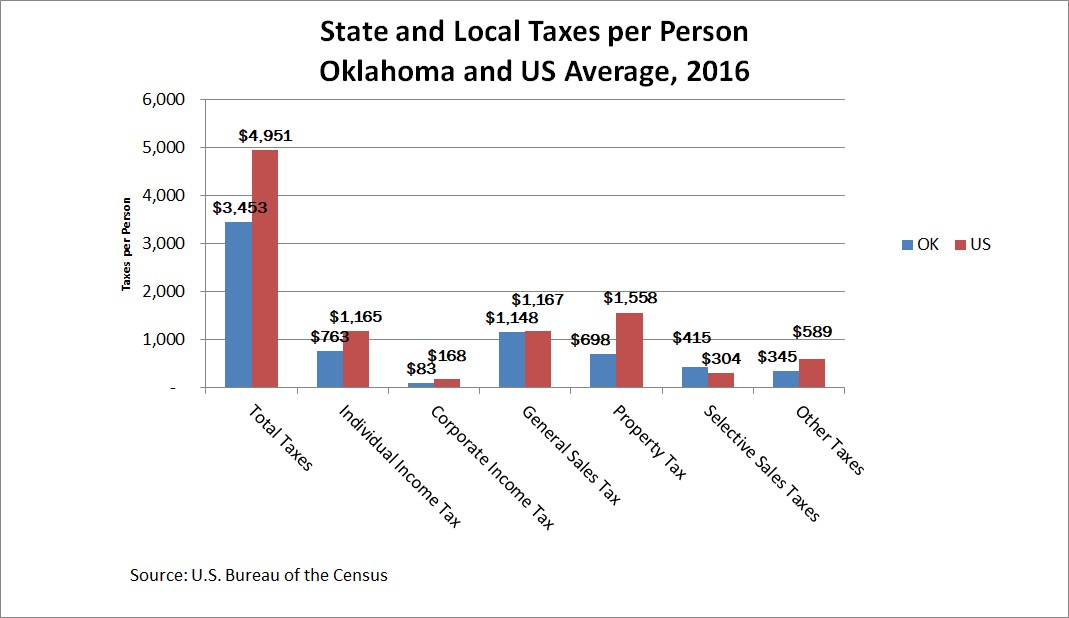

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma Personal Property Bill Of Sale Form Bill Of Sale Template Legal Forms Personal Property

Home Based Business Permit Philippines Inside Home Business Ideas Philippines Within Home Business Tax Deduction Motto Quotes Words Quotes Inspirational Quotes

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainmen Educational Service Burden Tax

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

9 States Without An Income Tax Income Tax Income Sales Tax

How To Get And Read Your W 2 Form Life Skills Employment Income Tax

Patriotic Invitations With Oklahoma Flag Oklahoma Flag Oklahoma State Flag Oklahoma